Taking Losses in Your Portfolio for Tax Benefit Purposes

Let’s face it, none of us ever go into an investment thinking it will not work out, but this does occur and can end up resulting in a loss. In these cases, we can use these losses to our advantage for tax planning purposes. Tax-loss harvesting is a powerful tool you can employ to convert losses into tax savings without diverting drastically from your long-term investment strategy or outcome.

Here’s how the strategy works:

First, make sure to consult with your financial advisor or accountant before making any decision based on what you learn here. Tax harvesting can be complex and change over time as tax laws change. Your financial professionals will have the best insight into current laws and practices.

Currently, investors can use unlimited losses to offset capital gains, but only claim up to $3,000 per year in losses against normal income. However, any unused losses can be carried forward to use in future year. For example, if you have a $9,000 loss, you can take a $3,000 deduction each year for three years. It’s important to understand that you won’t get the full $9,000 loss claim in one year unless you also have $9,000 in gains. Knowing this can help you offset other gains and income.

Doing this correctly is a 3-step process to ensure you are correctly following IRS guidelines:

- Sell your shares for a loss.

- Reinvest in a similar, but not identical position.

- Reinvest in the original position at least 31 days later.

This is a powerful strategy to help you reduce your effective tax rate and increase your net worth. When used properly, tax harvesting can make significant improvements to your investment portfolio over long periods of time. This works particularly well with index or passive mutual funds. You can sell a fund that is linked to an specific index and at the same time buy another funds that is linked to a similar but not identical index.

However, there are some instances when it doesn’t make sense to implement this strategy:

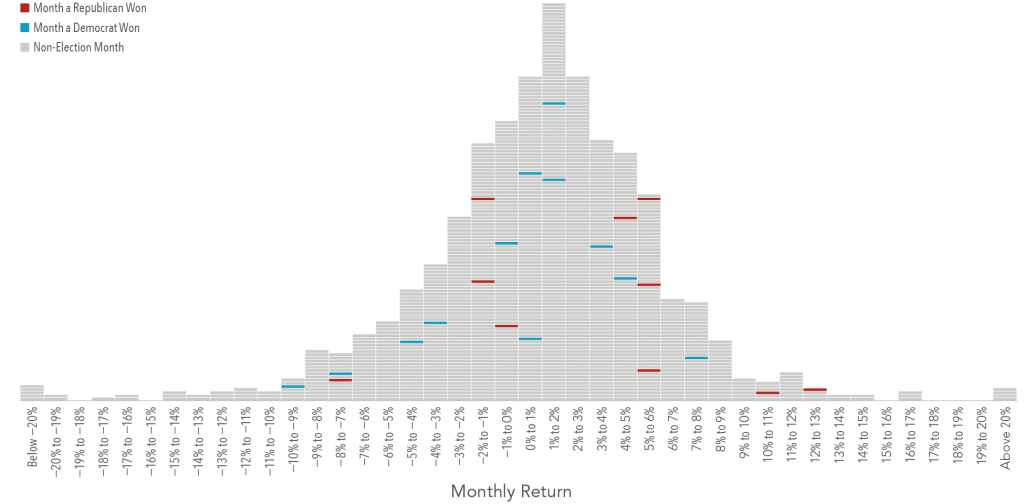

- If you plan on waiting 31 days to repurchase the original investment, it can be dangerous to utilize this strategy because of the dramatic market ups and downs that are present in these types of markets. It can be hard to time the trade exactly right and you may find that your loss turned back to break even in only one week’s time.

- Another poor implementation of this strategy is to use it when the trading costs don’t outweigh the tax savings. Remember that there are at least four trades involved here, each with a commission or a fee. When the tax savings will be minimal or equal to the total combined trading fees, it just doesn’t make sense to follow this model.

- This strategy only works in your personal investment accounts and cannot be used in any retirement accounts such as a 401(k), IRA or Roth IRA.

Taking a loss is never in the initial purchase plan and none of us like being in a investment that is currently down. However, knowing that there is a tax strategy that can help you save money on your taxes is very helpful to continue steady growth and remain secure in your wealth management strategy into the future. If you are concerned about losses in your portfolio, contact your financial advisor to determine if tax-loss harvesting is an option for you.

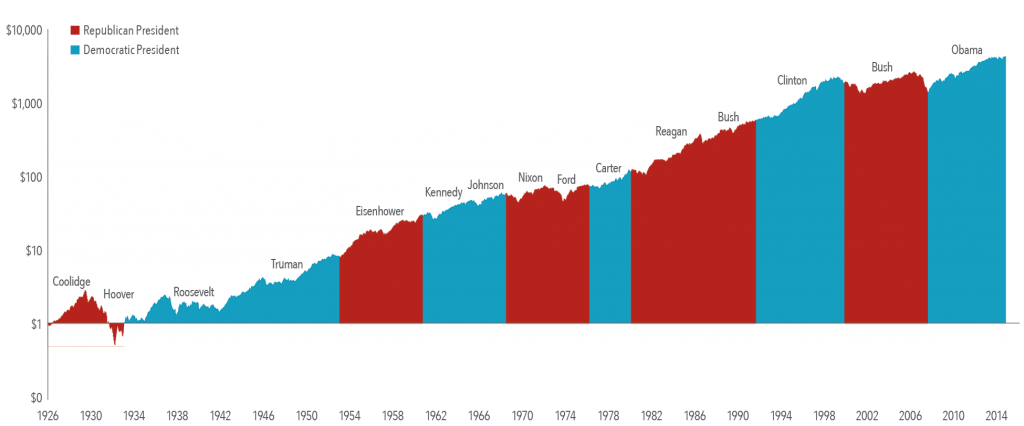

Over the last 90 days we, as a country, have experienced more election stress than I have ever witnessed. Personally, I have heard close friends and family members resort to vile language and physical intimidation tactics to get their point across. It has triggered a gamut of emotional responses from my own past traumas and includes the awareness of the traumatic experiences of my ancestors.

Over the last 90 days we, as a country, have experienced more election stress than I have ever witnessed. Personally, I have heard close friends and family members resort to vile language and physical intimidation tactics to get their point across. It has triggered a gamut of emotional responses from my own past traumas and includes the awareness of the traumatic experiences of my ancestors.