When you establish a trust, you name someone to be the trustee. A trustee does what you do right now with your financial affairs – collect income, pay bills and taxes, save and invest for the future, buy and sell assets, provide for your loved ones, keep accurate records, and generally keep things organized and in good order.

When you establish a trust, you name someone to be the trustee. A trustee does what you do right now with your financial affairs – collect income, pay bills and taxes, save and invest for the future, buy and sell assets, provide for your loved ones, keep accurate records, and generally keep things organized and in good order.

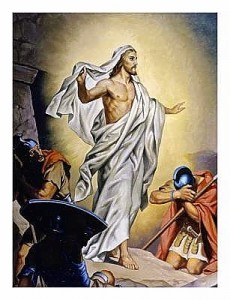

Easter Message

I realize that Easter, Christianity, and the issues surrounding resurrection beliefs can be ‘gospel’ to some, explosive trip-wires for others. My goal in presenting the following is simply to commemorate a significant event in the life and mission of Christ Jesus while also adhering to a conviction that spiritual laws are universal and demonstrated by enlightened ones of all faiths throughout time. Legendary mythologist, Joseph Campbell, includes ‘Resurrection’ as the 11th step in the classic Hero’s Journey, something identified in innumerable historical tales from diverse cultures. The life and message of Christ Jesus was unique to his world mission, as were those of Krishna, Buddha, and other illumined masters. Resurrection has been referenced or demonstrated by Guru Nanak of the Sikhs and Swami Sri Yukteswar in the yogic tradition, yet it is clearly a most notable event in the Christian faith and one that deserves respect for its spiritual significance. It is the significance of this event, however, that I believe the masters wished to emphasize, not so much the event itself. Namely, what they accomplished others can too – God willing – once they realize their innate divinity. I believe that Jesus labored very hard to get people on board with the message of “Ye too are Gods” and “Seek the Kingdom within.” To that end, his trials and triumphs reflect what we need to strive for, and do, in order to be true disciples of the One Spirit.

A Yogi’s Appreciation of Easter & Resurrection

“Resurrection is not the power of Spirit in the body of Jesus only; Spirit is in everyone. Nor does man have to die in order to resurrect Spirit. The physical resurrection of Christ was only part of the lesson of his life. Every time you give up a weakness and feel happy in being good, Christ is resurrected anew. You can bring Christ Consciousness within you right now…..” PY

“…Resurrect your calmness from beneath the soil of restlessness; resurrect your wisdom from the enshrouding earthliness of ignorance; resurrect your love from beneath the sod of mundane human attachment − with its limited love for family, society, and country − to divine love for all.” PY

For a Meditation on Resurrection click HERE